Looking into the Crystal Ball …

Looking into the Crystal Ball …

At Northpoint, we continue to closely monitor industry trends including the evolving 2024 statistics. In a nutshell, the 2023 model year outgrew demand and 2024 has continued that trend.

What’s ahead for 2025 and immediately beyond? Let’s look at the numbers, dealer and OEM insights and two important forthcoming economic triggers.

INVENTORY AGING REPORTS

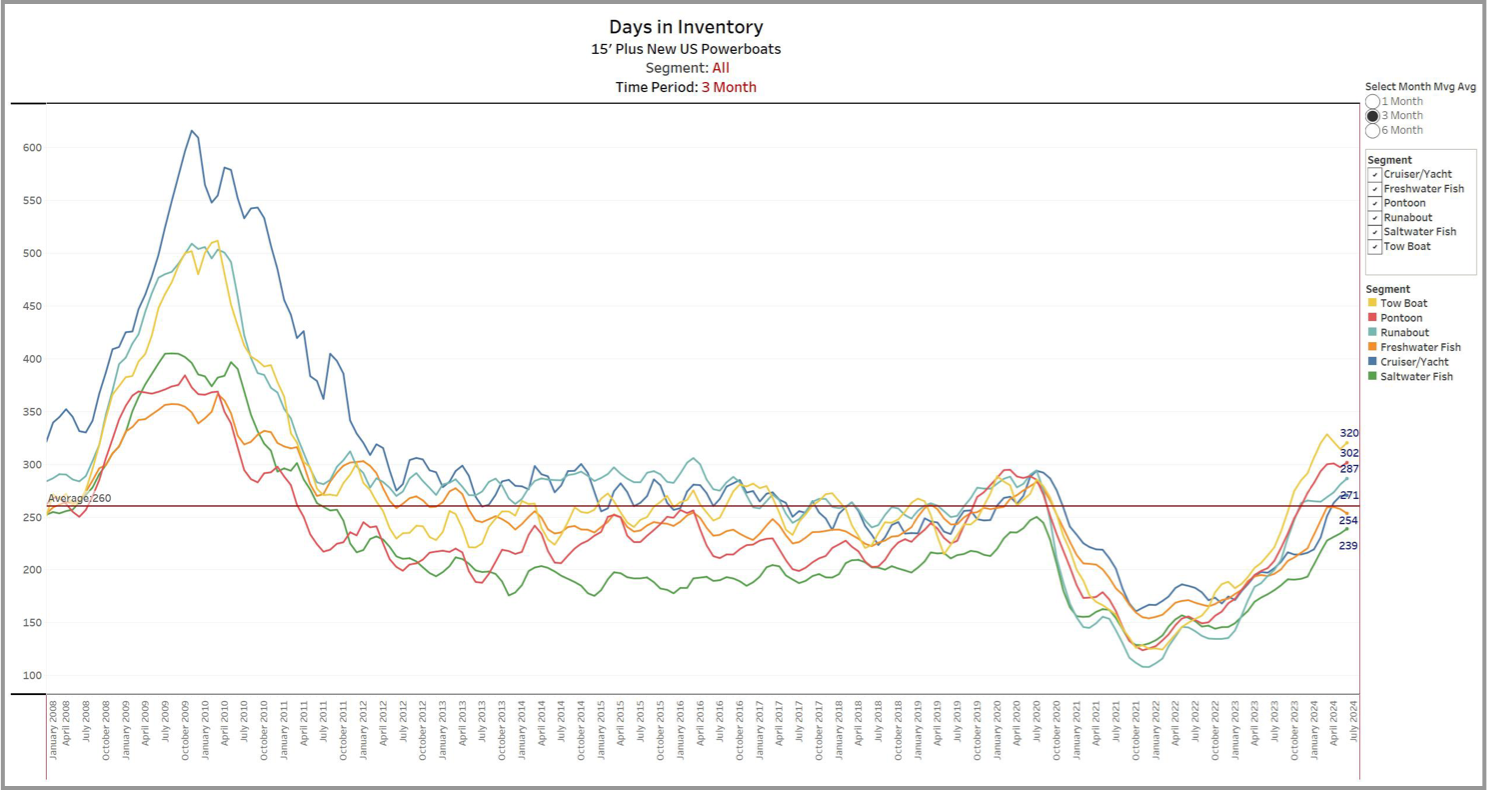

Info-Link’s Days Inventory Report this past July indicates the average ages of specific boat types: towboat, 320 days; pontoon, 302 days; runabouts, 287 days; cruiser/yacht, 271 days; freshwater fish, 271 days; saltwater fish, 239 days. All these latest stats rise well above the market target of 180-day inventory turns.

As we’ve analyzed the numbers and conferred with customers across multiple industry segments, our findings indicate we may have bottomed out.

The 2024 model year brought mixed results according to our current Northpoint portfolio. We continue to see an uptick in the aging over 12 months category which creates cash flow drains tied into aged inventory rates and curtailments. While Info-Link’s report reveals the actual number of boats sold through the model year was actually on par with model years 2016, 2017, 2018, 2019, 2022 and 2023, the caveat for 2024 is the aging inventory creep impacting the market today.

DEALER ATTITUDES & TURNS

Our participation and attendance at multiple dealer meetings have reflected an overall positive and optimistic tone. While many dealers are balancing their current cash constraints, they are continuing to order new boat inventory for the upcoming boat show season.

Our 1:1 conversation with dealers has run the full gamut, however, with the level of difficulty varying across the board. Some dealers are maintaining an inventory turn better than market by exceeding 2x, while others are experiencing an inventory turn better than 1.5x, allowing them to break even or nudge slightly ahead on cash monthly. Not surprisingly, others are struggling with managing turns better than 1x. Many of these dealers have kept their business afloat by relying on savings earned over the past few years, while others are forced to leverage assets to generate sufficient cash.

One troubling development we’ve recently observed is the desperate acts of a small handful of dealers who have turned to high-risk lenders known to charge exorbitant interest rates and fees. These “MCA lenders” mandate the signature of documents which allow them to sweep a customer’s bank account when they get behind. In addition, if dealers are late on payments, MCA-based loans increase dramatically due to compounding fees and interest which are incurred. Terms often include the rights of these lenders to take equity of the business and/or part of any future settlements.

At Northpoint, if we discover that these MCA lenders are actively engaged in our customers’ business, we are forced to exit the account. MCA lenders are unsecured creditors, meaning they typically give no notice to secured creditors. We encountered this type of lender more than a decade ago when the industry faced a true recession. We highly encourage our customers to avoid the high costs and extreme risks associated with these lenders.

As a reminder, our account team at Northpoint is here to assist and help dealers who may have questions or find themselves strapped for cash and facing difficult situations. We encourage you to confide in our team and let us help you review and discuss all available alternatives.

OEM INSIGHTS

In discussion with dozens of OEM customers, most have expressed cautious optimism based upon the volume of current boat orders secured for 2025 model year production. In fact, there is a small percentage in every category (aside from towboats) that have continued to thrive, in spite of the economic downturn.

Many OEMs developed promotional incentives and pricing strategies to stimulate dealership participation, which resulted in larger than anticipated new product orders. Although these OEMs understand that the cost of incentives and pricing adjustments may result in a short-term gross margin reduction, it keeps the business cash flowing with the opportunity to break even or meet some level of profitability.

There are also those high-performance OEMs that continue to lead their segment. These OEMs adjusted production early in the 2023 model year cycle in light of reduced customer demand. While their surplus field inventory may have some effect, these OEMs are not having to launch incentives and deploy discounts to the same degree as others.

As is the case with retail customers, we also recognize that a percentage of OEMs are struggling in these turbulent conditions. Some have been forced to reduce headcount and production capacity because of reduced sales.

NORTHPOINT SUMMARY

With dealers and OEMs working together and taking a more conservative approach to 2025, we should be well on our way to emerging in a positive position with needed cash flow relief in the near future.

We believe the light at the end of this tunnel is ahead. Once the presidential elections are concluded, we expect consumer confidence will return. In addition, the Federal Reserve has been public that rates WILL drop this year. Both these important key changes in the market will create a healthier environment to spur consumer purchasing activity.

Conversations with both dealer and OEM customers about how to achieve a successful 2025 model year occur daily throughout the Northpoint organization, centering on ideas to generate cash flow. We are happy to be part of these proactive conversations and plan to remain in close contact with our customers — both OEMs and dealers — to provide support and solutions to weather these market conditions.