Economic Overview & Current Insights: Recreational Marine Industry

By John Durnien and Russell Baqir, VPs Business Development

When economists say there’s a threat of a potential recession in the U.S. economy because of macro indicators, they don’t grasp that within the micro cycles of RV and Marine, the recession began two to three years ago.

As we begin to wrap the 2025 model year, it reflects a final reversal of declining Northpoint portfolio payoffs, along with dealer P&Ls bottoming out with high ratio of losses at the end of calendar year 2024. Interestingly, we also note slight signs of profit during the first half of the 2025 calendar year based on dealers’ Interim financial statements for 2025.

In a nutshell, the marine industry is not out of the woods yet … but based on the model year end, we may have hit the bottom with our liquidation ratio/inventory turn slightly improved over last year. June’s month-end was trending positive and better than 2023, although lower than 2019.

INVENTORY TURNS & AGING

In addition, the overall portfolio’s annualized inventory

turns improved better than 1.48x. We’ve not seen turns

improve to this level since 2023, as they were trending down. Specifically: cruiser/runabout trended at 1.48x; freshwater fish trended over 2x; inflatables trended under 1.3x; pontoon trended up 1.45x; saltwater fish trended to 1.42x; tow boat trended better than 1.6x; and the large boat segment turn is under 1.25x.

Inventory aging still does not reflect the benefit of increasing turns and portfolio liquidations. Overall aging remains greater than 20 percent, with little improvement in this area. The average age of marine inventory is now 265 days, with cruiser/runabout running just under 12 months; freshwater fish down to 190 days; inflatable over 260 days; pontoon to 290 days; saltwater fish up to 295 days; and tow boats over 275 days. Large boats are trending down, but still over 300 days.

The positive news is that less inventory is moving into 365-plus days compared to prior years, but the age in the field is nonetheless turning more slowly than desired.

DEALER/OEM CHALLENGES

Overall, dealers are experiencing greater sales success with new models and gaining decent margins, thus the earlier 2025 dealer interim statements are showing improvement compared to 2024. However, the struggle remains with liquidity/cash flow as the cost of the aged inventory continues to weigh heavy on monthly expenses. We anticipate this will continue to be a hurdle for the boat manufacturer/dealer meetings this year. Dealers will be driven to take lower inventory levels until they can sell/liquidate the aged inventory.

As a result, OEMs are feeling the direct impact of the inventory aging as dealers struggle with purchasing new inventory. We see many OEMs contemplating or turning to the boat club model for ways to maintain production capacity and while that’s a smart long-term approach, helping dealers in selling aged inventory should be key and will bring longer term benefit to their distribution channels.

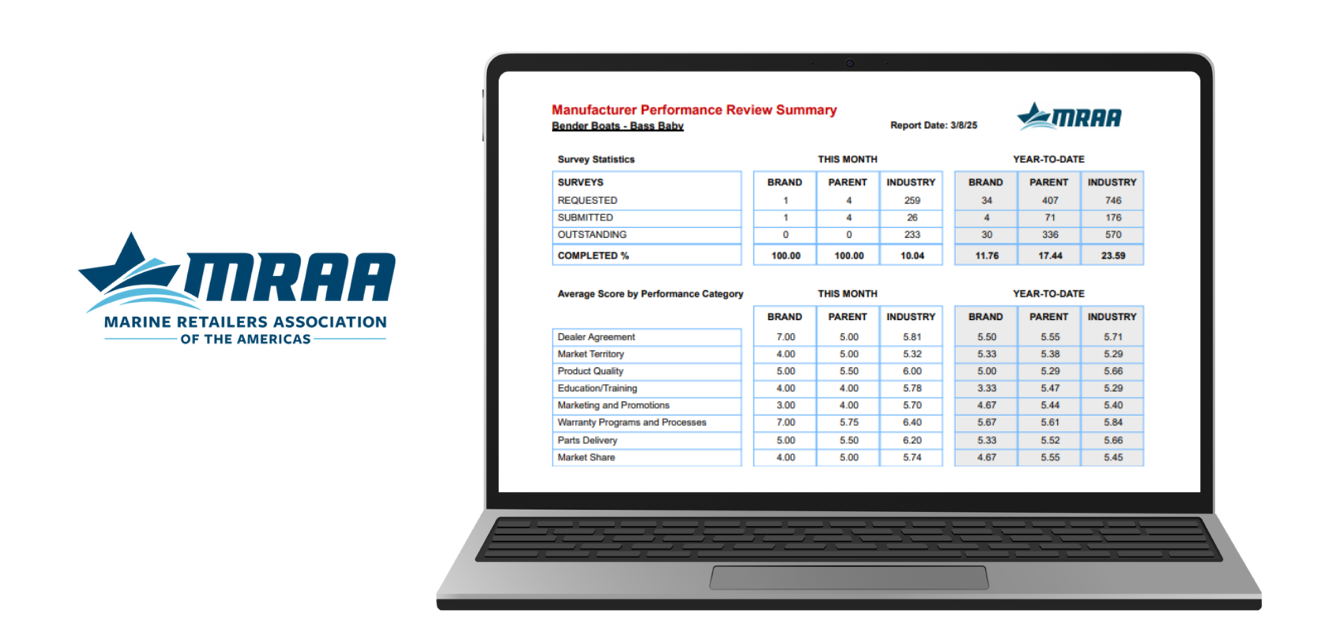

In addition, as we discern the growing friction between OEM and dealers regarding the challenging aged inventory dilemma, we are pleased by the MRAA’s recent announcement of its new “Dealer/OEM Scorecard” program which allows both parties to assess the others’ performance. This open approach to communication helps to set the stage for greater transparency and opportunity to find common ground. We highly recommend this new MRAA program be adopted and embraced by both parties.

INDUSTRY DILEMMAS

In other news, our operations and sales teams at Northpoint are clearly feeling dealer pain as they express frustration with paying curtailments. Sadly, we are seeing a percentage of dealers who have made the hard choice to exit marine. Others are doubling down and finding ways to maintain their equity payments in their inventory. We’re aware of stories including additional mortgages on property to alleviate monthly curtailments and eliminate higher interest rates on non-current inventory.

Another current dilemma facing our industry remains the cost of boating. Not factoring in storage, insurance or access, the cost of boats on average has risen by 38 percent since 2019, while the cost of motors financed increased by 18 percent on average. In terms of specific niches, the cost of pontoons has increased by 33 percent, while the cost of freshwater fish (aluminum and fiberglass) is up 48 percent. Conceptually, every dollar increase in cost eliminates a segment of potential buyers, while every decrease in dollar of cost adds more potential buyers.

Top of mind for many OEMS and dealers are interest rates, which are definite factors. However, we’d like to suggest that the continued focus on efficiency and cost reduction – while maintaining needed margins that are fair for buyers and sellers – would help reduce and stabilize the highs and lows of inventory turn throughout the industry. Independent of the interest rate factor, we do see that brands in all segments are able to continue a solid inventory turn through this downturn.

LOOKING FORWARD …

Looking ahead, there is hope on the horizon as we all become more comfortable with some of the recent economic disruptions. Keep in mind that leading economists have downgraded the risk of a macro recession. Inflation continues to trend downward. Interest rate decreases are now forecasted to be higher than the 1.0% previously expected, which adds more potential buyers. Inventory capacity continues to shrink, which will allow demand to catch up. The initial indicators we are seeing are that July liquidation was much better than expected, which will continue the improved financial results at the dealer level. And, initial feedback from early dealer meetings has been positive from both OEMs and retailers alike.

In closing, we are happy to share our perspective based on our experience in working with scores of OEMs and dealers throughout all segments of the industry. We appreciate the opportunity to serve our valued clients and to support your success through all stages of the journey. Here’s to better days ahead!