What We Are Watching

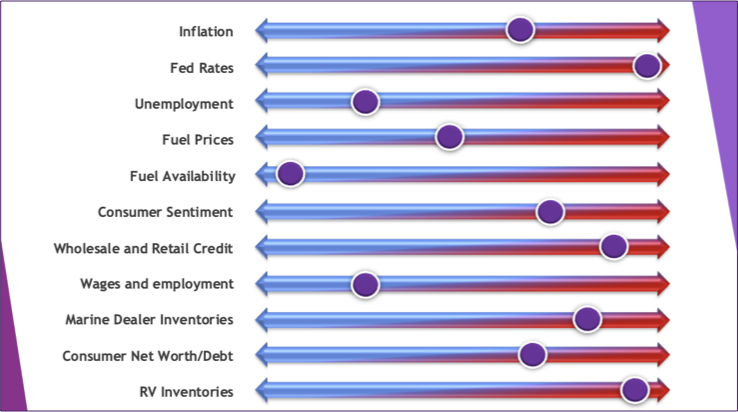

During the American Boating Congress, NMMA President Frank Hugelmeyer shared the chart below as part of his State of the Industry address including key areas of industry focus.

Chart Courtesy NMMA

As you review the chart, notice the arrows in red pointing to the right which identify areas that are driving down consumer confidence and slowing sales.

Two of the key drivers include:

- Inflation: there have been some strides in getting inflation growth back at an acceptable rate. Overall, the Federal Reserve wants to see this growing at 2.0% or lower. We are close to achieving this ratio, but other indicators are slowing the Federal Reserve from easing the Fed Rates.

- Fed Rates: the current indication is the Fed will raise these rates one more time prior to the end of the year. We all are asking WHY?

Despite these challenges and others, the underlying economy remains strong based on unemployment remaining low at 3.5%. This has a direct impact on cost of housing or rent – additional indicators – which has not declined.

Without question, there are many issues that impact the market and influence consumer response. In this brief column, we’re simply providing a simplified snapshot to represent a complex economic situation.

As is reflected in the overall marine industry observations depicted in the NMMA chart, the Northpoint portfolio likewise is exhibiting decline in consumer confidence.

- Inventory turn has declined compared to the 2019 selling season. The product groups bearing the brunt of this are Pontoon, Tow Boats and Freshwater Fish. Saltwater is also affected, but not to the extent of the other segments.

- Ageing update: our ageing over 12 months is currently running around 10% which is in line with a “normal” seasonal cycle. By comparison, the ageing over 12 months was under 4% this time last year. It is clear the transition of business with ageing below 5% to “normalization” is painful for dealers.

The Lesson of Curtailments

There was a time when floorplan lenders would try to gain a competitive edge by eliminating curtailments to try and capture more market share. History proved this was a hard lesson for both dealers and OEMs as inventory ageing began choking the OEM’s distribution channels. Dealers stocked more inventory because the ramifications were not immediately felt. This prolonged the marine industry downturn as it took much longer to cycle through the inventory. In addition, the glut of non-current inventory caused retail finance companies to cut back their advance rates, which compounded the effect and further prolonged the cycle. In addition, dealers were unable to absorb the reductions on the advance rate because their inventory was sitting at 100% of the original invoice.

Some important points to consider about curtailments.

- Curtailments represent pent-up cash flow that becomes available to the dealer when the boat sells.

- Curtailments give dealers the ability to discount products during times when inventory turn is slowing. As a dealer discounts inventory to move it, it serves as a rebate he has given himself with the positive effect to cash flow. In addition, it also yields a positive effect to the dealer’s balance sheet as he invests in his business.

- Finally, the dealer gets the benefit of reducing interest expenses as it lowers principal balance. If a dealer wants a lower rate, pay down the principal for an immediate effect.

Pent-Up Demand on the Rise

We believe there remains pent-up demand for boating activity based on several indicators.

- Boat club memberships are growing.

- There is a pent-up demand from consumers who would have traded in their boat during the past four years and purchased new but have chosen not to do so yet. This may be attributed to the high cost of new products during the pandemic and the desire to wait for a “righting” of the pricing and more available inventory.

- Repower is reportedly on the rise, potentially a contributor to why consumers are holding on to their current product longer than anticipated.

Good News: if the rates stabilize or decline over the next 12 months, we expect a percentage of current boat owners will return to dealerships with purchase intentions.

Looking Ahead

- As an industry, we are looking at a difficult Fall and Winter to get us to the retail show season.

- The Federal Reserve is not helping with another increase in the rates on the horizon.

- This is the time for marine businesses to pivot and find ways to generate additional cash flow. Promoting service, winterizing and storage are important solutions.

- Every business should focus on ways to reduce expenses.

We also recommend retailers consider a relationship with a highly reputable and proven service provider which offers the ability to generate a greater volume of approvals and thereby help maximize revenue for dealers’ retail paper. Northpoint’s solution-minded approach includes the recommendation of Elite Recreational as a powerful ally and turnkey provider for our retail partners. To learn more, visit www.eliterfs.com