We are pleased to introduce the Northpoint Navigator, our bi-monthly e-newsletter designed for our valued marine customers and industry colleagues. We hope you will find the content both relevant and interesting.

This column – View from the Lighthouse – will rotate out each issue between the two of us, featuring timely news, insights and updates. For this inaugural edition, we have collaborated to bring you our latest Marine inventory and ageing snapshot.

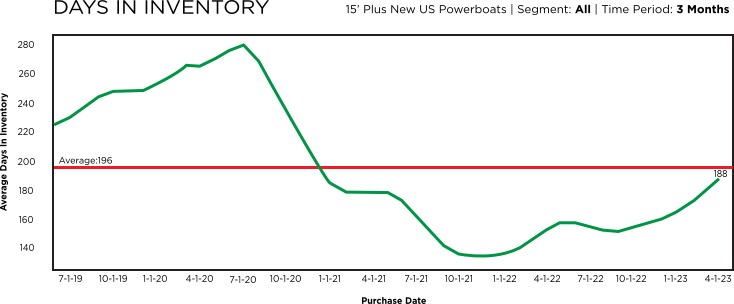

No surprise to anyone, the market has slowed during the 2023 Model Year. Reference the Info-Link Days Inventory Report chart, which reflects a healthy industry based on inventory ageing at 188 days.

However, as you see, the trend is increasing the number of days to turn inventory.

The Northpoint portfolio likewise is exhibiting similar trends. Inventory turn plateaued in April 2023 compared to 2019 turn. We saw inventory turns trending up in May but still not at the 2019 turn ratio. Our ageing over 12 months is currently running around 6% which remains historically lower than this time of year in a more “normal” seasonal cycle. By comparison, the ageing over 12 months was under 4% this time last year.

Consumer purchases continue to drop from all-time highs in 2020 and 2021, to 2019 levels or lower. The scarce inventory position that marine experienced at the beginning of this model year is over. As reflected in the chart, Marine ageing does remain in excellent shape, but the flattening inventory turn/sales will continue to trend toward ageing month over month. Dealers will be impacted by both curtailments and age inventory rates in early Fall and through Winter.

We are also starting to see the gap between new inventory cost and used inventory cost begin to widen. As you’re aware, this is an additional indicator of slowing the new inventory turn in future months.

If the 800,000 first time buyers over the past two years return boats at a higher ratio than expected, it could lead to a longer downturn cycle in marine. If these buyers retain the product and consumer repos remain low, it will be a shorter downturn. An additional variable that could shorten the slowdown in Marine are current boaters who have extended ownership of their current boat instead of trading it in for a new boat or upgrade. This pent-up demand could help strengthen the market if these buyers get comfortable with price increases and higher interest rates.

We have several dealers who have outperformed the slowing inventory turn and they accomplished this by enacting two strategies: 1) Re-examining their pricing; and 2) contacting and working every lead from the current and the past. It is evident that the consumers are still in the market; they just need a compelling reason to make the purchase now.

By comparison, we continue to see RV turn/liquidations slowing … and RV did not have an inventory scarcity situation like Marine. So, the RV industry is further into a slowing cycle than marine. Aged inventory over 12 months in RV was less than 1.0% this time last year and has increased more than 15% today. These dealers are working feverishly to balance their cash flow as curtailments and aged interest rates increase.

RECOMMENDATIONS

Based on present and potential economic and market conditions, we recommend Marine Dealers undertake the following precautions:

1. Work to maximize the dealership’s gross margin, but don’t lose sales. The industry has not seen rates at this level since the 1990’s and early 2000’s. This increase in debt for inventory will drain businesses of their cash flow. Working to find the balance of profitability while keeping an inventory turn of 2x or better will be critical.

2. Seek other alternatives to both maintain and grow cash flow. Storage, service and accessories

will be critical to maximize. If there is free and clear inventory available, consider rental options. Northpoint offers a rental program to turnkey this income opportunity for you to generate additional cash flow. If there is an interest, please contact your Northpoint Sales team member (below) to discuss this program. Additionally, check on the MRAA training site for additional income producing ideas.

3. Reduce debt. In an environment with rising cost for debt service, finding ways to reduce your dependence on it will assist through this time.

4. Northpoint’s sales team has a tool to assist in forecasting costs of ageing inventory. We make this tool available to the industry, whether you’re a Northpoint customer or not. Please reach out to our team members for a complimentary consultation so you can gain a perspective of what Fall or Winter may have in store concerning your cost of inventory.

NORTHPOINT CONTACTS

Patrick Boys, Insides Sales Representative

[email protected] TEL: 651.964.3733

Troy Stenerson, Marine Territory Manager

[email protected] TEL: 651.374.8929